Refund-ready tool

Fast-track your tax rebate with ease.

We help workers, freelancers, and everyday earners claim back every penny they’re owed from HMRC — without the confusion. No tax knowledge? No problem. Just answer a few simple questions, and we’ll handle the rest. Built for speed. 💸 Designed for maximum refund. ✅ HMRC-compliant.

We are backed by

PROBLEM

Claiming a tax refund shouldn't feel like filing a court case.

Most workers don’t even realise they’ve overpaid tax. And those who do? Often get stuck with jargon-heavy forms, confusing rules, or delayed HMRC responses.

SOLUTION

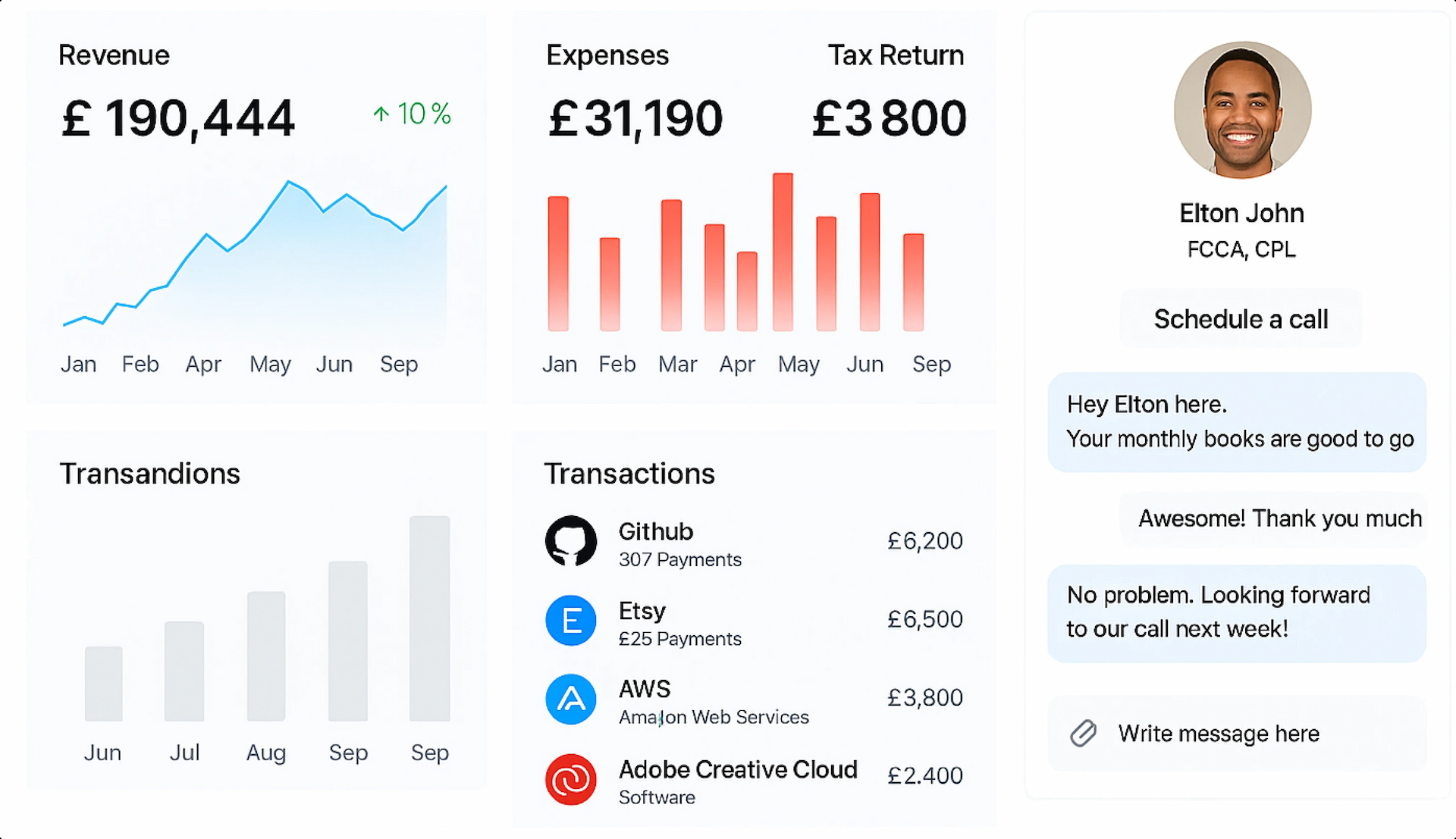

Your tax refund partner that saves time, removes guesswork, and puts money back in your pocket.

CIS & PAYE refund experts

- We specialise in tax rebates for construction workers, employees, and freelancers who’ve overpaid tax.

Transparent & compliant

- We stay fully HMRC-aligned, ensuring your claim is legit, secure, and risk-free.

Done-for-you process

- From eligibility checks to filing with HMRC — we handle it all. No jargon. No stress.

Personal support, real humans

- We don’t hide behind bots. Our team’s always here to guide you and explain everything in plain English.

Fast payouts, real results

- Claim back hundreds — often thousands — in overpaid tax, usually within 7–10 working days.

Clear, simple pricing

- Only pay when you get paid. No upfront fees. Just a fair success-based model.

Tailor-made for your tax situation

Our intuitive software helps all types of workers claim their tax refunds — quickly, accurately, and with zero stress.

- We match your profession to the right tax reliefs — from CIS to NHS uniform claims and beyond — automatically.

- No paperwork? No problem. Our software uses HMRC-approved logic to calculate typical expenses based on your role.

- Once your refund is ready, we prepare, file, and track the claim directly with HMRC, so you don’t have to lift a finger.

- Our team is here to answer questions, explain your claim, and guide you at any point — just a message away.

Get Started

BENEFITS

Why get your tax back is different and better?

| Features | Get your tax back | Traditional accounting firms | Traditional accountants |

|---|---|---|---|

| Built-for-you platform | No forms, no jargon | You handle it all | Usually not rebate-focused |

| Real tax refund value | Claim the most you're owed | Often underclaimed | Generic advice |

| Specialised team (rebate experts) | Yes | No | Not always |

| Fast turnaround | 7-10 days | Delays common | Weeks/months |

| HMRC submission | Fully managed | You file it | |

| Success-fee pricing | Fair & transparent | Paid tools | Expensive hourly fees |

| Data privacy | Bank-level secure | Depends | Varies |

Integrations

We work with your business software

Get started with Coventry accountants

Discover if you’re owed money by HMRC — it takes 60 seconds to find out.